Reinsurance Matters! Part 2 Workshop for RI Department officials:

Indian General Insurance Industry has grown more than 17 times since opening of the Sector in 2001. With 33 General and Health Insurance Companies in business, Reinsurance capacity requirements of Indian Insurance companies have also grown manifold.

With the Insurance Amendment Act 2015 permitting Branches of Global reinsurers to be set up, Lloyds Corporation and 10 Global reinsurance majors have already set up Branch offices in India. Tax concessions for Insurance and reinsurance companies to be set up in International Finance Centre in GIFT City, near Ahmedabad has also created keen interest has been evoked among international Reinsurers to open business units.

Thus, a foundation is being laid to build Reinsurance capacity, capabilities, professional expertise and infrastructure within India, and we are sure that an important regional Hub can be established in India to canter to Afro-Asian Insurers.

Indian Reinsurance premium volume at 31st March 2019 levels can be estimated USD 7 Billion (approx. 30% of Gross Domestic Insurance premium).Flagship Crop insurance schemes (PMFBY), Frequent and Severe Natural disaster events, Newer Risks (e.g., Cyber liability) Newer products (e.g., Title Insurance) and Large industrial risks and infrastructure projects, and innovative insurance solutions and products, require crucial reinsurance capacity and protection. With India’s huge untapped insurance potential, both Insurance and Reinsurance business would grow further.

Keeping the growing Reinsurance business potential in focus, the Programme Coordinator has visualized the need for comprehensive knowledge sharing on Reinsurance Fundamentals, practices and Reinsurance market dynamics to develop a talent pool of Reinsurance professionals in India. Programme Director has designed a three-part Reinsurance Knowledge sharing programme on the theme “Reinsurance Matters!

The first part of this tri-series focused on Fundamentals of Reinsurance, Underwriting, Claims and Accounting aspects. It was successfully conducted on 25th and 26th November 2019 at Orchid Hotel, Near Mumbai Domestic Airport. This programme was designed to give a basic conceptual understanding of Reinsurance business principles and practice. In all, 58 Participants from Insurers, Reinsurers, Reinsurance intermediaries (Insurance Breakage Firms) and Software companies attended the programme.

This is the second part of the tri-series, 2-day training programme/ workshop scheduled to take place on 23-24 Jan, 2020 in Mumbai. It is aimed to help Officers in Insurance and Reinsurance Companies to gain practical knowledge on application of Reinsurance fundamentals and types of Reinsurance Contracts, in designing a basic Reinsurance Program, preparing the data submissions for obtaining Reinsurance quotations, Terms and conditions relating to Claims, Technical accounts and administration of the Reinsurance transactions that would arise out of the various Reinsurance contracts.

This second programme of the Tri will include following important:

- A Quick Recap of Types and Methods of Reinsurance contracts – Using sample RI slips

- Data Submissions for a typical Annual Reinsurance Programme for General Insurers

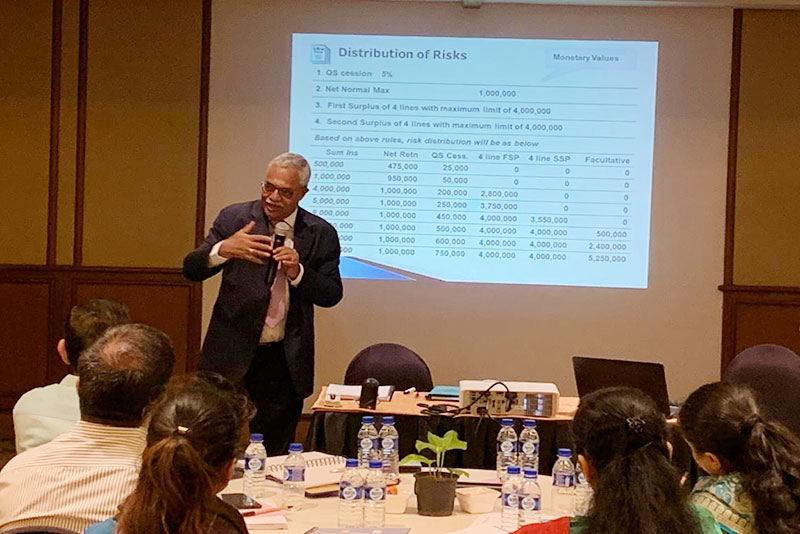

- Designing a Reinsurance Programme Structure (through case studies)

- FAQs between Reinsurers and Insurers during Negotiation of RI Terms; as well as Administration of RI Contracts during the year

- Typical issues faced by Insurers – Rendering of Technical accounts – Quarterly accounts, Sliding scale commission, Profit commission statements, Portfolio withdrawal and entry accounting, Adjustment accounts for Excess of Loss – Burning Cost methods, other adjustment accounting etc.

Practical examples and Case-study methods would be adopted. Opportunity would be given to the participants to work out the case studies. The faculty Comments and feedback would be given

Teaching Method to be adopted will be:

- Pre Reading material will be sent to participants

- Participants are expected to send their questions/ queries/ doubts so that faculty can include these in lectures & discussions.

- Group Discussions

- Problem Solving.

- Presentations by selected Group Leader

- The objective will be to improve the level of the participants, who are going to handle higher responsibility in the near future.

Who Should attend the Training Programme (Target Participants):

- This is a good opportunity for Officials and Employees working in

- Insurance Companies

- Reinsurance Companies/ Branches

- Insurance Broking Firms (handling Reinsurance business)

- KPO’s providing Reinsurance services to Indian and foreign clients

- Reinsurance Consultants

What you can expect from the training Programme?

Every official involved in Reinsurance functions in insurance companies and Reinsurance Intermediaries is handling only a portion of Reinsurance activity, many a times without complete knowledge of what and why they are doing them. Many officers are busy with either facultative placements or preparing treaty accounts using IT system. This programme will be ideal for them to develop keen interest in the subject, understand the work they are doing and enthuse them to pursue a career as a Reinsurance professional.

The participants would be expected to be working in Reinsurance Underwriting, Claims or Accounting areas and have gained basic understanding of the concepts and working examples reflecting the day to day reinsurance operations and administration.

The participants working or would be handling the Reinsurance function of the organization would gain immensely, if they attend this programme – dealing with technical aspects of how a Reinsurance Programs can be tailored to meet the needs of clients and the day to day administrative and accounting issues that need constant attention.

Participation fee

- Individual participant fee: Rs 20,000/- each

- Group participation fee (team of 3 persons and above): 18,000/- each

- Individual Foreign Participant fee : US $ 500

* We reserve our right to choose from multiple nominations.

Note: Prior registration/ confirmation is required to attend this Training so that Logistics/ Study Material can be organised accordingly.

Accommodation:

This is non residential programme; however good reasonable hotels in Andheri, Vile Parle, near Domestic Airport are available in surrounding areas. Programme Coordinator will be ready to assist you in arranging the same (if required).

Certificate:

Certificates will be issued to the participants on completion of this Training Programme.

Tailor Made Training Programme:

We will be pleased to conduct Training Programmes as per your requirement at your location. Let us know your requirement at vp@ifingo.org

Contact Details

Mahender Soni

Programme Coordinator, Insurance Foundation of India, Om Plaza, 430/7, 1st Floor, Sant Nagar, East of Kailash, New Delhi – 110065

Mobile: 7678689961

Email: vp@ifingo.org