Why need for Training Programme on “Insurance Claims Management”- How to Manage Claims Settlement Successfully??

Insurance Policy is a contract between Insurance Company & Insured. It is a legal document and is going to be used when the claim is lodged by the Insured. Most of the customers are ignorant about this fact and face difficulty when the claim is lodged.

In this programme we will be discussing in detail about the importance of various aspects of claims.

- Lodging of Claims

- Interaction with Insurance Companies/ Surveyors.

- Importance of accounting records

- Need for a team effort in interaction with Insurance Companies/ Insurance Surveyors

Claims to be covered in details are:

- Property (including Project, Engineering, Mega Risk) Insurance Claims

- Marine Cargo Insurance Claims

- Liability Insurance Claims

- Health Insurance Claims

- Cyber Insurance Claims

- Loss of Profit (Business Interruption) Claims

- Life Insurance Claims

Topics to be covered:

- Why need for Training Programme on “Insurance Claims Management”?

- Realize the Importance of Policy Wording. Claim settlement depends on it.

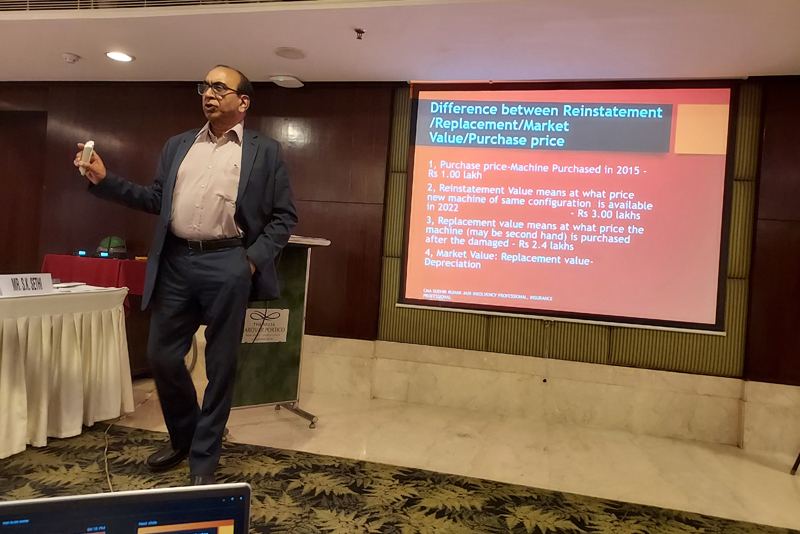

- Property, Project, Engineering and Mega Risks – Claims Case Studies & Learning

- Realize the Importance of your Team which will handle the Claims, when need arises – Procedure

- Case Studies on Health Insurance Claims

- Retail

- Corporate

- How to avoid repudiation of claims

- Role of Insurance Consultant in claim settlement

- Property

- Motor

- Marine Cargo

- Health

- Life Insurance Claims

- Retail

- Group Policies

- Frauds detected/ claims repudiated

- Claims Intricacies of Loss of Profit (Business Interruption) Insurance

- Surveyor’s Prospective on Property/ Project/ Engineering Insurance

supported with case studies - Need and importance of a law firm’s assistance at the time of buying insurance, lodging claims, pending claims, repudiation/no claim

- Claims cases in Courts – Who wins & who loses?

- Major Case Studies

Who Should Attend the Training Programme (Target Participants)?

This is a good opportunity for:

- Corporates (Manufacturing/ Traders/ Exporters / Importers / Infrastructure)

- Banks/ NBFC Firms

- Claims Department Officials in Insurance Companies

- Insurance Brokerage Firms

- Surveyors Loss Assessors/ Investigators/ Detectives

- Law Firms

- Chartered Accountants

- Members from Chambers of Commerce and Industry

- Insurance Consultants

What you can expect from the Training Programme?

- Importance of process & systems in your organization

- Assets Register

- Timely additions/ Increase in Sum Assured

Some Key Take Away for Various Stake Holders will be:

- Understanding of Insurance Claims

- Legal Provisions/ Legal framework

- How insurance Companies look/ Detect frauds/ Fake/ inflated Claims

Training/ Delegate Fee:

Participation fee (Includes Training, Study Materials & Lunch)

- Individual participant fee: 3500/

- Group participation fee (team of 3 persons and above): Rs.3250/-each.

- Group participation fee (team of 5 persons and above): Rs.3000/-each

Note: Prior registration/ confirmation are requested to attend this Training Programme so that Certificates/ Logistics/ Study Material & Lunch can be arranged accordingly.

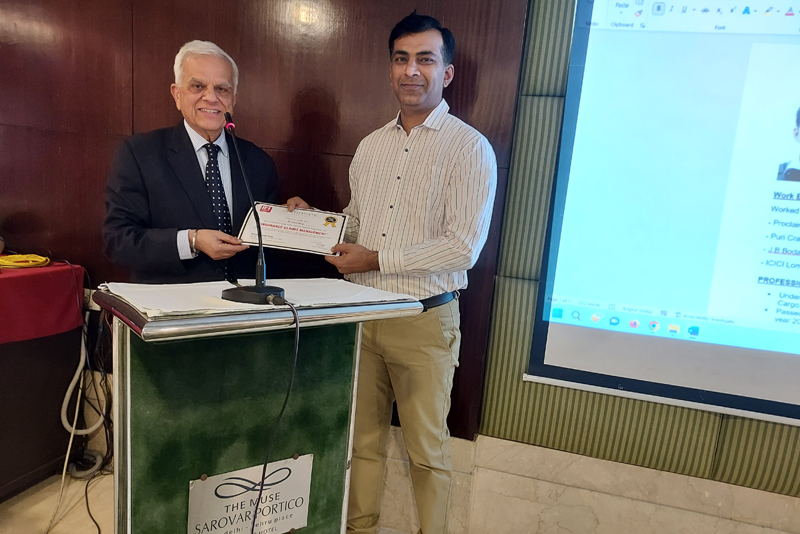

Certificate:

Certificates will be issued to the participants on completion of this Training Programme.

Accommodation:

This is non- residential Training Programme; however reasonable hotels/ guest houses are available in surrounding areas such as Panchsheel Enclave, Hauz Khas, Greater Kailash & South Extension. Programme Coordinator will be ready to assist you in arranging the same (if required)

Contact Details

Anirudh Katiyar

Om Plaza, 430/7, 1st Floor, Sant Nagar, East of Kailash, New Delhi - 110065

Mobile: 7678689961

Email: vp@ifingo.org