Registration can be done online at https://forms.gle/GHxnFWGPEYLwzPEC7

Why need for Specialized Industry Focused Training Programme on Risk Assessment and Fire (Property) Insurance?

Fire and allied perils are devastating for any business venture whether it is a manufacturing unit or service provider such as hospitals and hotels.

Most businesses realize at the time of claim that the claim amount is not payable because proper risk assessment has not been done at the time of taking the policy. Businesses fail to realize that risk cannot be managed only by taking insurance policy. It is their responsibility for maintaining the safe environment to conduct the business. The insurance policy will not cover the risks associated with organization if it fails to fulfill the conditions attached to policy.

This programme will give an opportunity to participants to interact with faculty, who have vast experience of dealing with businesses and claims worldwide. Participants will be able to learn about common mistakes that cause hardship to organizations.

Fire not only causes losses to organization’s assets and life but severely affects the goodwill and future growth of the organization. In many cases owner, promoter and directors face prosecutions as we have noticed in the case of fire in certain cinema halls/hospitals in the recent years in different parts of the country.

Objectives of the Training Programme:

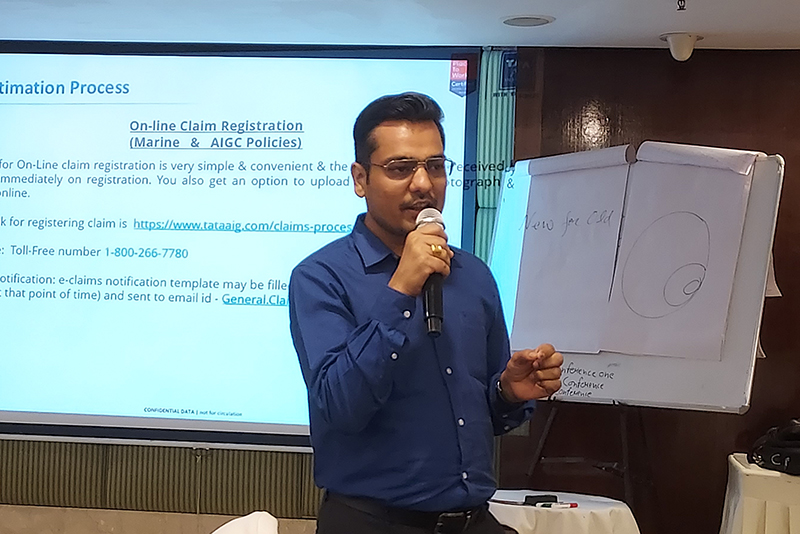

This training programme is very practical in nature and is case study based to provide practical understanding of risks associated with fire and allied perils. The aim is to discuss and come out with solutions for difficulties faced during purchase of insurance policy, lodging and settlement of claims.

The programme is structured in such a way that it promotes interaction among managers/executives of:

- Firms who purchase fire insurance polices

- General Insurance Company involved in Business Development, Selling, Underwriting and managing Fire Insurance Claims

- Insurance brokers who are most important insurance intermediary

- Surveyors who are an important link in processing/ settlement of insurance claims.

Topics to be covered:

Every session will be followed by Questions/ Answers so that high level of clarity is achieved, which assists you in your career development.

- Introduction/ Risk Assessment – Necessity

- Fire Hazards and Fire Prevention – Importance

- Underwriting/ Evaluation

- Important Clauses under fire insurance

- Perils and Add on cover

- Tips to avoid disputes in fire Insurance Claims

- Claims Procedure – how to expedite it explaining with live cases

- Legal Aspects & Procedural Aspects

- Case Studies

- Mega Projects

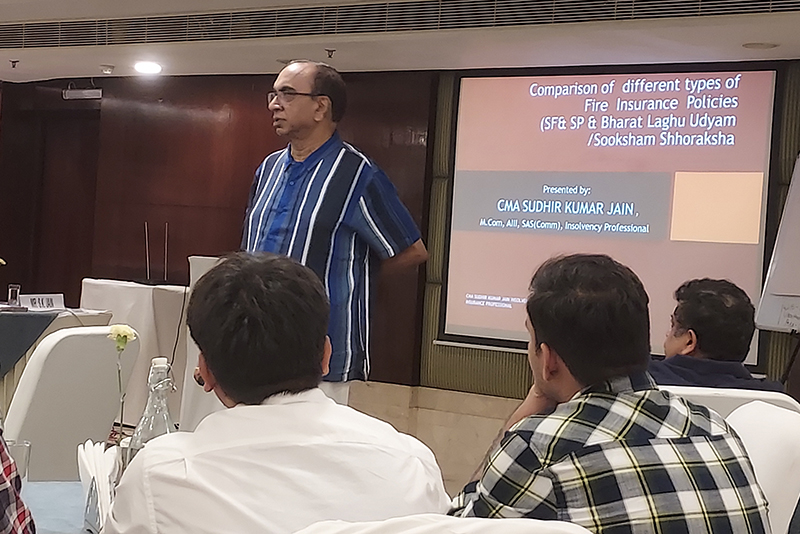

- Comparison of SF & SP and Bharat Laghu Udyam Policy

- Action Required at your end when major accident takes place

- Immediate action

- Set up Task Force

- Procedure

- Interaction with Surveyors/ Insurers

- Involvement of your Insurance Intermediary

- When you need Insurance Claim Consultant/ Lawyer?

- Surveyor’s Prospective

- Major Claims – which got repudiated

- Legal Aspects/ Litigation

- Business Interruption Insurance (Loss of Profit Policy). Why corporates are buying it?

Who Should Attend the Training Programme (Target Participants)?

This is a good opportunity for:

- Managers/ Risk Mangers handling purchase of insurance and lodging of claims from

- Corporates

- Trading companies

- Manufacturing firms

- Exporters/ Importers

- Educational institutes

- Hospitals

- Hotels

- Shopping Malls/ Multiplexes

- IT companies

- SME’s etc.

- Managers/ Executives of Insurance Brokerage Firms – Business Development/ Underwriter/ Claim Department.

- Managers/ Executives of General Insurance/ Reinsurance Companies involved in business development, selling, underwriting and management of claims

- Surveyors (members of Indian Institute of Insurance Surveyors and Loss Assessors)

- Consulting firms providing risk management services, claims management services

- Academic-Faculty members/ students specia-lizing in Insurance planning to make career in General Insurance.

What you can expect from the Training Programme?

This executive development programme on Risk Assessment and Fire Insurance Claims will provide the participants with comprehensive, multi-functional perspective on how to assess risk, maintain processes for risk mitigation, comply with statutory procedures on containment of risk and management of claims.

- Policy terms are Important- Buy Right Product

- How to get a claim payment in 60 days – Insurance client

- How to get your client’s claim settled in 60 days – Insurance Brokers

- How to complete your assignment in 30 days – Insurance Surveyor

- Managing your risk – cost effectively – Insurance client/ Managers of Insurance companies.

60 days to passing of an insurance claim is what we will focus on. Time is money, as the claims process gets extended the cost for all the stakeholders goes up. It results in financial and goodwill loss for all the stakeholders, who are involved.

Training/ Delegate Fee:

Participation fee (Including Training, Study Materials & Lunch)

- Individual participation fee: Rs. 3800/

- Group participation fee (team of 3 persons and above): Rs. 3400/- each.

- Group participation fee (team of 5 persons and above): Rs. 3200/- each.

Accommodation:

This is nonresidential Programme; however reasonable hotels/ guest houses are available in surrounding areas such as Nehru Place, Greater Kailash I & II, Panchsheel Enclave. (Nearest Metro Station Nehru Enclave & Nehru Place) Programme Coordinator will be ready to assist you in arranging the same (if required)

Venue:

The Muse Sarovar Portico, New Delhi

Certificate:

Certificates will be issued to the participants on completion of this Training Programme.

Contact Details

Ashwini Kumar

Om Plaza, 430/7, 1st Floor, Sant Nagar, East of Kailash, New Delhi - 110065

Mobile: 7678689961

Email: vp@ifingo.org