Why the need for Specialized Industry Focused Training Programme on Insurance Frauds Control?

Insurance Frauds is a worldwide phenomenon. According to ‘Coalition Against Insurance Fraud’ (a leading organization of USA) estimates Insurance Industry in USA is losing $80 billion a year across all lines of insurance. Estimates by India Forensic Research are that in our country this figure is in the range of Rs 45000 Crores per year and is increasing at a rapid pace. In other words in India on an average every insurance company loses 8.5% of its revenues to the frauds. This means that the profit of insurance companies is being eaten up by various persons, many are connected with this Industry directly, many are clients and then there are large numbers of criminals. Indian Government, IRDAI (The Regulator), many other Government Agencies and all Insurance Companies are anxious to bring Insurance Frauds under control so that the benefits in the form of reduced premium, higher profits and higher tax revenue to the Government can be utilized for the growth of the Indian Economy.

Fraud can occur at any stage of an insurance transaction. Various stakeholders who may be connected with Insurance Frauds are:

- Insurer Employees

- Insurance Intermediates and their employees

- Insurance Brokerage Firm

- Insurance Marketing Firm

- Corporate Agents

- Web Aggregators

- Insurance Surveyors & Loss Assessors

- Insurance Service Providers to Insurance Surveyors & Loss Assessors

- Service Providers to Insurance Companies

- Automobiles Workshops

- Health Care providers

- Third Party Administrators

- Insurance Clients ( Corporates as well as Individuals)

- Criminals in association with anti social elements

Objectives of the Training Programme:

For insurance frauds to be proactively addressed, insurers must train their staff in identifying the proposals, which give scent of fraud. The interaction among the stakeholders who will be present will result in interaction (high focus on questions & answers) so that they can understand

- How Insurance Frauds are being committed in India/world?

- Why top management should give due importance to screening at proposal stage so that watch is kept at fraud at every level i.e. issue of policy to Claim Settlement?

- Use of Forensic Science/Modern Technologies/ Data Analytics as a necessity to track and blacklist fraudsters

- Measures by the Surveyors to detect and identify characteristics that distinguish fraudulent claims from valid claims

- Roles and responsibilities of management and staff in proactively reducing fraud, through prevention and controls.

- Periodic reporting requirements to the regulator (IRDAI)

Topics to be covered:

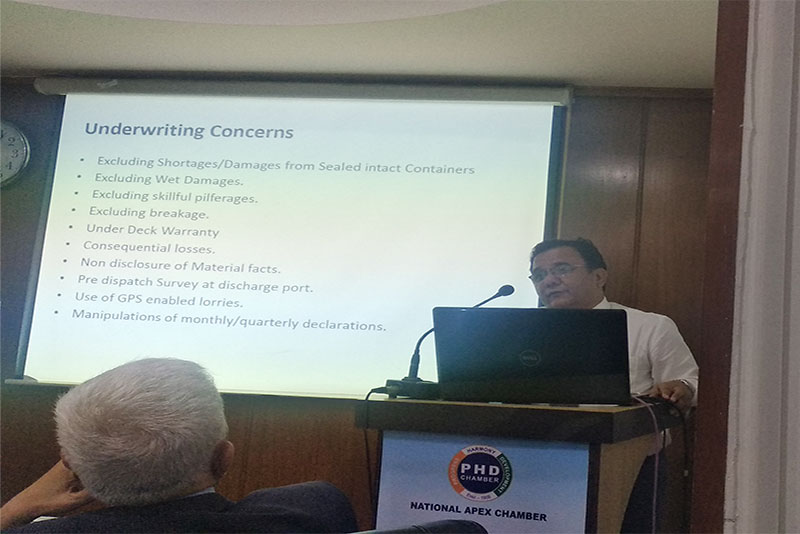

During this Training Programme high level of clarity will be achieved by discussing the following

- Insurance Frauds in the world and in India

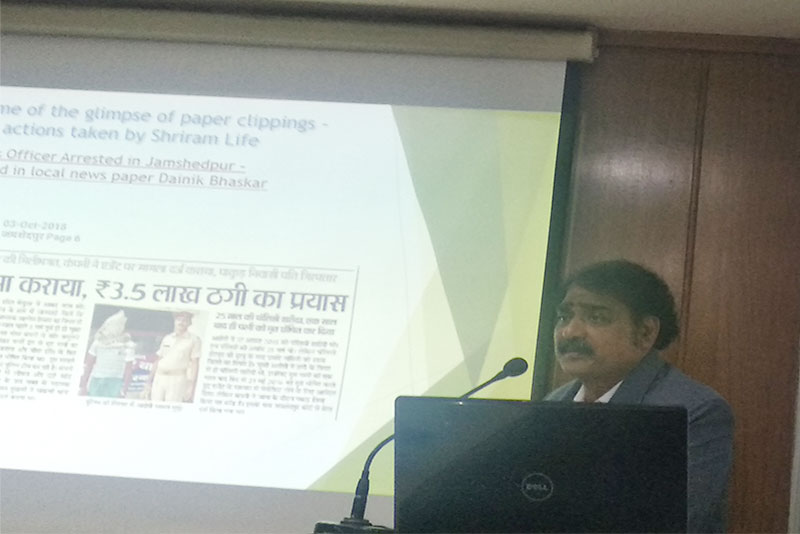

- Case Studies of Insurance Frauds in India

- Motor

- Health

- Life

- Marine

- Case Studies on Insurance Frauds across the world

- How Forensic Science/ Modern Technologies/ Data Analytics being used in Insurance Frauds Detection

- Legal Perspective about IPC, Is it capable of controlling the Insurance Frauds?

- Need for new Law to control the Insurance Frauds in 21st Century

- What needs to be done for

- India needs Insurance Fraud Control Act

- Formation of Statuary Body to collect data/ disseminate Insurance Frauds data

- Sharing of data of fraudulent people and cases centrally and on all India basis, on real time basis and that too at low cost

- Is there role of Aadhaar/ PAN card in fraud Detection

Who Should Attend the Training Programme (Target Participants?)

This Training Programme is a good opportunity for :

- Insurance Company’s Senior Management/ Managers responsible for Business Strategy/ Fraud Control/Claim settlement

- Finance, Audit, Internal Audit and Legal staff who support insurance practitioners in keeping watch on frauds

- Managers involved in the strategic overview of how to approach risk, fraud within the organization

- Insurance Surveyors & Loss Assessors

- Third Party Administrators and other Service Providers

- Insurance Brokerage Firms/ Corporate Agents/ Agents

- Law Firms

What can you expect from the Training Programme?

This training programme on Insurance Fraud Control will provide the participants with a comprehensive, multifunctional perspective on how to :

- Assess risk, comply with statutory procedures on the management of claims while keeping an eye on Frauds

- To set, promote, monitor and enforce high standards of integrity, financial soundness, fair dealing and competence of those it regulates

- To bring about speedy and orderly growth of the Indian Insurance Industry for the benefit of the common man/ Insurer/ Intermediates and to provide long term funds for accelerating the growth of the economy

- To ensure speedy settlement of genuine claims, to prevent insurance frauds and other malpractices and put in place effective Grievance Redressal Mechanism

- Need For “Insurance Frauds Control Act”

- How we should reach Law Ministry, Government of India to initiate this process

Delegate/ Participation fee:

- Individual participant fee: Rs 3500/- each

- Group participation fee (team of 3 persons and above): Rs 3250/- each

- Group participation fee (team of 5 persons and above): Rs 3000/- each

Note: Prior registration/ confirmation are requested to attend this Training so that Logistics/ Study Material & Lunch can be arranged accordingly.

Accommodation:

This is non residential Programme, however good reasonable hotels/ guest houses are available in surrounding areas such as Panchsheel Enclave, Hauz Khas, Greater Kailash & South Extension. Programme Coordinator will be ready to assist you in arranging the same (if required).

Contact Details

Ms. Shveta Kaushal

Programme Coordinator, Insurance Foundation of India, Om Plaza, 430/7, 1st Floor, Sant Nagar, East of Kailash, New Delhi – 110065

Mobile: 7678689961

Email: vp@ifingo.org